Azania Capital Limited

THE BANK’S INDEPENDENT SUBSIDIARY

Azania Capital Limited (ACL)

Azania Capital Limited (ACL) is the bank’s independent subsidiary to undertake capital markets activities to complement the banking services. This is a strategic business line to the bank having strong synergy with banking services and using the bank’s balance sheet as a leverage to attract more investments and business opportunities.

This full-fledged independent subsidiary is involved with capital markets activities including fund management services, investment advisory services, stock brokerage agency services and eventually will be transformed to provide brokerage services.

Although the bank plays an active role in the capital markets as it directly invests and trade in securities, but the level of involvement is somehow limited with respect to allowable services it can offer. The presence of ACL provides an effective platform for other players and the public in their investment choices and enhance access to the market and offer various products and services.

Among the stakeholders involved in the capital markets activities are Capital Markets and Securities Authority (CMSA) being the regulator of capital markets, Tanzania Mercantile Exchange (TMX), Dar es Salaam Stock Exchange (DSE) and other stakeholders include fund managers, investment advisors, brokers and dealers who provide various products and services to the market.

STATUS ON ACTIVITIES BEING OFFERED BY

Azania Capital Limited (ACL)

Azania Capital Limited (ACL) has gone a long way in establishing its place within the capital markets space. It is now implementing its Five Years Strategic Business Plan which mostly focus on fund management services in the initial years of operations. It has been instrumental in ensuring Azania Bank’s corporate bond issuance becomes a success where its first tranche called Bondi Yangu has been oversubscribed by nearly 200% in December 2024.

The company is currently working on developing new products and services that will be offered to the market. Some of the products being considered include My Bond, Our Bond, Staff Retention Benefit Scheme, and new Collective Investment Schemes of various terms and conditions. These products are expected to create high volume of transactions within ACL business model that will complement the bank’s business and operations.

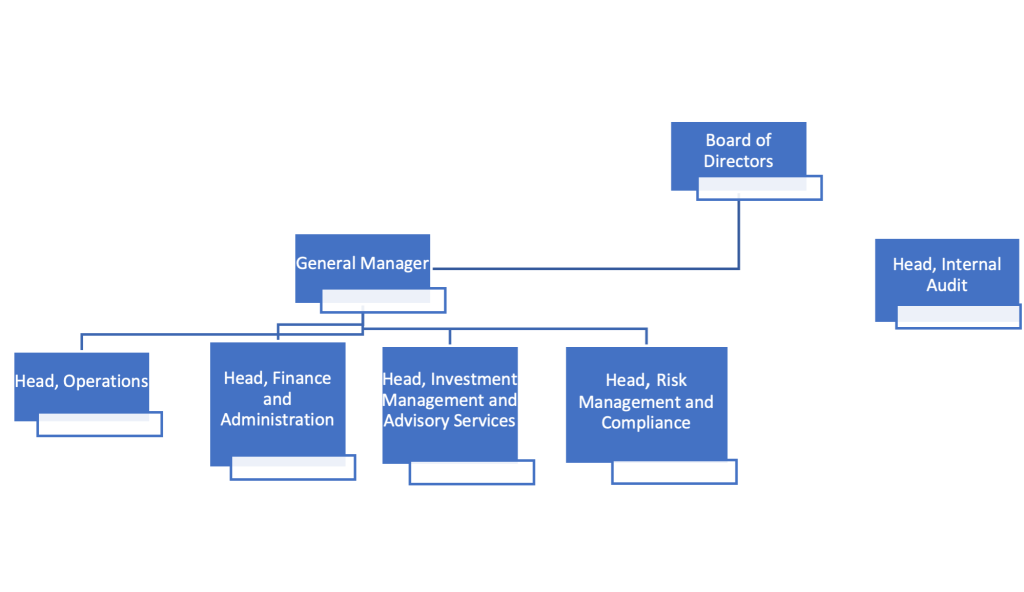

AZANIA CAPITAL LIMITED

Organizational Chart

AZANIA CAPITAL LIMITED

Summary

Azania Capital Limited (ACL) is ready to collaborate with the bank on supporting its Custodian Services to the market, partnering on the establishment of a well and proper desk for Fixed Income Instruments and Structured Products that will aid in exploring and tapping opportunities available in the capital market space, knowledge sharing and collaborate jointly with the bank to pitch for business opportunities to various institutional and high net worth individuals.